Latest News

The Millerton 175th anniversary committee's tent during the village's trunk-or-treat event on Oct. 31, 2025.

Photo provided

MILLERTON — As Millerton officially enters its 175th year, the volunteer committee tasked with planning its milestone celebration is advancing plans and firming up its week-long schedule of events, which will include a large community fair at Eddie Collins Memorial Park and a drone light show. The events will take place this July 11 through 19.

Millerton’s 175th committee chair Lisa Hermann said she is excited for this next phase of planning.

“As we enter our anniversary year, there is a clear sense of excitement throughout the village and surrounding communities,” Hermann said. “Local businesses and organizations have been eager to get involved and help make this a truly special event for our community.”

Throughout 2025, committee members attended local events and gatherings to promote the celebration and hear ideas from businesses and residents.

Hermann said momentum continues to build as the committee works to finalize details and ensure the celebration honors Millerton’s rich history while remaining fun and engaging for all ages.

“It has been especially meaningful to hear longtime community members share stories from past celebrations and reflect on their cherished village memories,” she added.

In the months ahead, organizers plan to finalize vendors, secure additional sponsors, and continue spreading the word. Submissions are now open for musical acts, food truck vendors and sponsors wanting to promote their business while offsetting the cost of hosting such an event. Several sponsorship opportunities are available, including support for fair elements such as a stage, tent, activation and more.

The committee is also working with local businesses, including The T-Shirt Farm, to stock branded anniversary merchandise. Marketing efforts have increased, and members plan to attend more community events and seek opportunities to spread the word on TV, radio and printed materials.

Locals and visitors can follow updates on the committee’s Facebook page, which is beginning to reveal a schedule of events packed with family-friendly fun. Organizers hope people will share the page widely as a one-stop-shop for event information.

“This week-long celebration is shaping up to be another unforgettable chapter for our community,” Hermann said. “We hope the event itself will become one of the many memories that make Millerton such a wonderful place to call home.”

Keep ReadingShow less

Why the focus on Greenland?

Jan 28, 2026

As I noted here in an article last spring entitled “Hands off Greenland”, the world’s largest island was at the center of a developing controversy. President Trump was telling all who would listen that, for national security reasons, the United States needed to take over Greenland, amicably if possible or by force if necessary. While many were shocked by Trump’s imperialistic statements, most people, at least in this country, took his words as ill-considered bluster. But he kept telling questioners that he had to have Greenland (oftenechoing the former King of France, Louis XIV who famously said, “L’État c’est moi!”.

Since 1951, the U.S. has had a security agreement with Denmark giving it near total freedom to install and operate whatever military facilities it wanted on Greenland. At one point there were sixteen small bases across the island, now there’s only one. Denmark’s Prime Minister has told President Trump that the U.S. should feel free to expand its installations if needed. As climate change is starting to allow a future passage from thePacific Ocean to the Arctic, many countries are showing interest in Greenland including Russia and China but this hardly indicates an international crisis as Trump and his subordinates insist.

Researchers believe that, buried beneath the mammoth glaciers covering most of the land are rich deposits of various rare earth minerals including those needed for modern batteries and other hi-tech devices. Trump has already made a deal with Ukraine to supply them more arms in return for rights to its underground “rare earth” deposits. Some have called this extortion but to Trump it was business as usual. Greenland’s buried treasures could be a much bigger deal.

But perhaps Trump’s lifelong obsession with size is the dominant reason he feels he must have the world’s largest island; like his planned White House ballroom, for him this is essentially an ego trip.

Greenlanders and Danes have made it clear from the beginning that they do not wish to become American and are not for sale, Trump’s subordinates have tried to advance a scheme whereby Elon Musk might buy a majority of the individual Greenlanders’ votes to sell their country to the U.S.; however Denmark has the last word and is not about to agree to selling Greenland to anyone.

Although Greenlanders have largely been in favorof eventual independence, since Trump’s intemperate demands they have locked arms with Denmark. Recently, large demonstrations in both places have expressed anger, but even more, sadness that their staunch ally would turn against them.

Other than Trump’s appointees those who support the President’s claim to Greenland are hard to find in the U.S. or elsewhere. While most Republican political leaders have avoided speaking out on the matter, a few have including Senators Thom Tillis of North Carolina and former Majority leader Mitch McConnell of Kentucky, both condemning the possible “taking” in no uncertain terms . Seasoned diplomat, Michael McFaul has called Trump’s insistence on “owning” Greenland as “the worst idea in American history.”

After speaking to the assembled crowd of political leaders and industrialists at Davos, Trump began discussions with Mark Rutte, secretary General of NATO and others after which, in a striking turnaround,he announced that they had put together the basis of a “deal” regarding Greenland.

But neither Greenland nor Denmark had been involved in those discussions; both rejected the agreement’s proposal that the United States would have sovereignty over the military bases both new and existing. Another facet of the proposal giving the U.S. control of underground mineral rights may proveexcessive to both Greenland and Denmark.

Although everyone seems relieved that the crisis appears to be largely over, the rupture between Europe and the U.S. remains. Considering President Trump’s erratic state of mind (in his speech at Davos he referred to Greenland as Iceland at least 3 times), who knows what he may demand tomorrow?

Architect and landscape designer Mac Gordon lives in Lakeville.

Keep ReadingShow less

Military hardware as a signpost

Jan 28, 2026

It is hard not to equate military spending and purchasing with diplomatic or strategic plans being made, for reasons otherwise unknown. Keeping an eye out for the physical stuff can often begin to shine a light on what’s coming – good and possibly very bad.

Without Congressional specific approval, the Pentagon has awarded a contract to Boeing for $8,600,000,000 (US taxpayer dollars) for another 25 F-15A attack fighters to be given to Israel. Oh, and there’s another 25 more of the F-15EX variant on option, free to Israel as well.

Meanwhile, many European countries have switched their purchases of the F-35 fighters to the French Rafale or the Joint European Fighter as well as Saab’s advanced concept fighter Gripen.Turkey and Airbus, meanwhile, have sold the Hurjet trainer to Spain and other countries over the US trainer. And France is about to begin laying the keel for a new aircraft carrier (though that will take almost a decade). Meanwhile, Airbus is now, since 2024, the primary supplier to all EU countries for military helicopters… Saab is making GlobalEye airborne aircraft for France, Italy and Germany… France’s Rafale Company is making and delivering Iron Beam high-energy laser weapons… Airbus has ramped up delivery to all its new EU customers of 18 new C295 tactical transports.

Some may wonder why EU leaders as well as the UK, have been so soft tongued when it comes to this Administration’s recent diplomatic transgressions over Greenland (oops, Iceland?). The reason is simple: For decades the US has been the cheapest and best supplier of the finest military hardware – planes, tanks, weapon systems, and defense capability. What every nation understood was that the US held the controls of the safe operation of those aircraft. For example, the electronics of every F-35 can be controlled remotely from the US. Go against us? We can pull the plug. That was never an issue before, where we had trust and mutual goals. The current rush to re-prioritize local EU manufacture and longer term self reliance in the EU is a direct consequence of this Administration’s changing of priorities and allied trust.

It is true that DJT can take credit for EU and UK increased military budgeting and preparedness, his actions have forced them to that reality. It is also true that his long term damage to American jobs and industry are just now becoming evident as less of our hardware is attractive to foreign buyers and our military oversight will be slowly eroded to a position where nations no longer feel the need for diplomatic or industrial reliance on America.

Peter Riva, a former resident of Amenia Union, New York, now lives in Gila, New Mexico.

Keep ReadingShow less

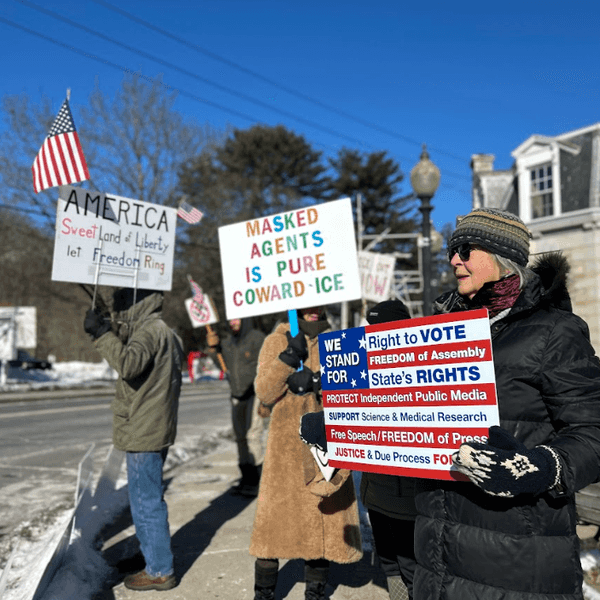

A small group of protesters voice opposition to President Trump's administration and Immigration and Customs Enforcement at Amenia's Fountain Square at the intersection of Route 44 and Route 22 on Saturday, Nov. 8, 2025

Photo by Nathan Miller

The fatal shooting of Alex Pretti, and before him Renée Good, by federal agents in Minnesota is not just a tragedy; it is a warning. In the aftermath, Trump administration officials released an account of events that directly contradicted citizen video recorded at the scene. Those recordings, made by ordinary people exercising their rights, showed circumstances sharply at odds with the official narrative. Once again, the public is asked to choose between the administration’s version of events and the evidence of its own eyes.

This moment underscores an essential truth: the right to record law enforcement is not a nuisance or a provocation; it is a safeguard. As New York Times columnist David French put it, “Citizen video has decisively rebutted the administration’s lies. The evidence of our eyes contradicts the dishonesty of the administration’s words.”

Separately, law enforcement agencies across the country are expanding their capacity to watch the public. Here at home, as we’ve reported, Dutchess County’s Real Time Crime Center brings together feeds from automated license-plate readers, including systems provided by Flock Safety, allowing police to track vehicles across jurisdictions in real time. These tools collect detailed movement data on vast numbers of people who are not suspected of any crime, often with limited public discussion of safeguards or oversight.

When citizens document state power, they are told to step back or trust official explanations. When the state documents the public, continuously and at scale, it is framed as efficiency. One form of observation is treated as suspect; the other as routine.

What magnifies the alarm in the Minnesota shootings isn’t just the loss of life, but the response that followed. Federal force was used against members of the U.S. public, and officials responded not with clarity or accountability, but with statements that collapsed under visual evidence. That willingness to lie, and to do so reflexively, signals a deeper problem: an administration increasingly willing to treat truth as an obstacle rather than an obligation.

A democratic society depends on shared facts. The right of citizens and journalists to observe, record, and document matters because it anchors truth in evidence, not authority. That right is not a threat to public safety. It is among the few remaining tools the public has to insist that power remains answerable to the truth.

Keep ReadingShow less

loading