Latest News

A speed enforcement camera in New York City.

Photo courtesy NYC DOT

Speed cameras remain a tough sell across northwest Connecticut — and are still absent from local roads in neighboring Dutchess County.

Town leaders across northwest Connecticut are moving cautiously on speed cameras, despite a state law passed in 2023 that allows municipalities to install them. In contrast, no towns or villages in Dutchess County currently operate local automated speed-camera programs, even as New York City has relied on the technology for years.

In both states, officials say speeding remains a concern on local roads — particularly on through roads and in residential areas — but questions about cost, enforcement and public support have slowed momentum outside large cities.

For border communities in northeast Dutchess County, where traffic crosses state lines daily, the Connecticut debate hits close to home.

Supporters of speed cameras argue the technology can slow traffic and improve safety, particularly in communities with limited police coverage. Critics worry cameras could turn small towns into “speed traps,” and raise concerns about surveillance.

That caution mirrors the picture statewide in Connecticut. Since the law took effect, only 11 of the state’s 169 municipalities have implemented speed cameras.

In New York, automated speed cameras are widespread in New York City, where hundreds operate year-round in school zones under authority granted by the state Legislature.

However, unlike Connecticut’s opt-in law, New York requires separate legislative approval at the state level for each municipality to install local speed cameras. That authority has not been granted to towns or villages in Dutchess County.

Limited authorization has been extended by the state legislature to a small number of municipalities, including White Plains, Kingston, Schenectady and Albany.

As a result, automated enforcement in Dutchess County is currently limited to state-run work-zone speed cameras — temporary devices installed by the New York State Department of Transportation in active highway construction or maintenance areas that ticket drivers who exceed posted speed limits.

Connecticut towns can opt in, but few have

Washington is the only town in western Connecticut to adopt speed cameras so far, and officials there say the program is already changing driver behavior.

“Speeds are coming down,” said Washington First Selectman Jim Brinton, noting cameras were installed in May 2025. “We had tried everything — speed bumps, education. This is the only option that’s showing positive results.”

Elsewhere in the region, the response has been far more skeptical.

In Kent, voters overwhelmingly rejected a proposed speed-camera ordinance by a 391–100 margin in January 2025.

“I’m concerned about the atmosphere cameras create,” resident Lianna Gantt said during a public hearing. “Are we turning our town into a speed trap?”

Interviews with first selectmen in North Canaan, Falls Village, Sharon and Kent — along with responses from officials in Salisbury and Cornwall — show a shared concern about speeding but hesitancy to move forward with cameras.

A new law, but a complicated path

Connecticut’s process for implementing speed cameras is extensive. Towns must adopt a local ordinance, present a traffic enforcement plan at a public hearing and secure voter approval at a town meeting or referendum. Any approved plan must then be reviewed by the Connecticut Department of Transportation.

Towns must also install camera equipment and complete a mandatory public awareness period of at least 30 days before issuing citations.

After that warning phase, drivers may be fined $50 for a first violation and $75 for subsequent offenses if they exceed the speed limit by more than 10 miles per hour. Camera systems are operated by third-party vendors, which provide images of alleged violations for municipal review.

Each violation must be approved by a qualified municipal employee, contracted agent or law enforcement officer before a citation is mailed — a requirement many small towns say strains limited staff, particularly those without resident state troopers.

Sharon studies cameras after traffic analysis

With Kent having voted down the program, Sharon appears furthest along in northwest Connecticut in considering speed cameras.

First Selectman Casey Flanagan said the town began studying the option after a traffic analysis found widespread speeding on several local roads.

The study, conducted by Dacra Tech, examined six locations, including Route 41 southbound, Rhymus Road, Calkinstown Road and Williams Road.

“When they averaged it out, it came to almost 33,000 citable events a month on just six roads,” Flanagan said. “Some of these numbers are quite staggering.”

Sharon does not have a resident state trooper, meaning review of potential violations would likely fall to town staff.

“We need to figure out who is going to review the pictures and determine whether a citation gets mailed out,” Flanagan said, noting that the town is still studying the concept. “That could be me, or we could hire someone.”

While vendors have told town officials that citation volumes typically decline as driver behavior changes, Flanagan said Sharon is not rushing a decision.

“There really isn’t a clock on me right now,” he said.

Other towns opt for softer measures

North Canaan is expanding its use of digital speed feedback signs rather than pursuing cameras.

“No one has been asking for it,” First Selectman Jesse Bunce said.

The town is installing additional speed feedback signs along Route 44 and Sand Road through the state-supported Connecticut Speed Management Program, which also provides detailed speed data.

“Once we have that data, we can evaluate what to do next,” Bunce said.

Falls Village tested a temporary speed-monitoring camera about 18 months ago but ultimately pulled back.

“We found out the speed was not as great as we thought it was,” First Selectman David Barger said. “It was more perception than reality.”

Barger said the town relies on speed feedback signs and remains cautious about cameras, citing cost estimates of $26,000 to $28,000 per two-way unit and the lack of staff to review violations.

“The only reason we would want speed cameras is for safety,” he said. “It would not be a revenue generator.”

Salisbury and Cornwall also have no immediate plans to pursue speed cameras, though Salisbury First Selectman Curtis Rand has said he is not opposed to “a mechanical way of lowering speed.”

Washington offers a nearby example

Washington approved a speed-camera ordinance unanimously in December 2024 and began issuing citations in May after years of resident complaints.

Since then, the town has issued 13,748 citations totaling about $696,000 in fines, with roughly $525,000 collected as of late January, according to Brinton.

A town constable reviews images in-house, a process that now takes about 10 hours a week.

“It was pretty overwhelming at first,” Brinton said. “The volume initially caused a lot of struggles.”

Brinton stopped short of recommending cameras for every community but said Washington’s experience shows the technology can work when tailored to local conditions.

“Every town is different,” he said. “But it has worked for us.”

Keep ReadingShow less

In remembrance:

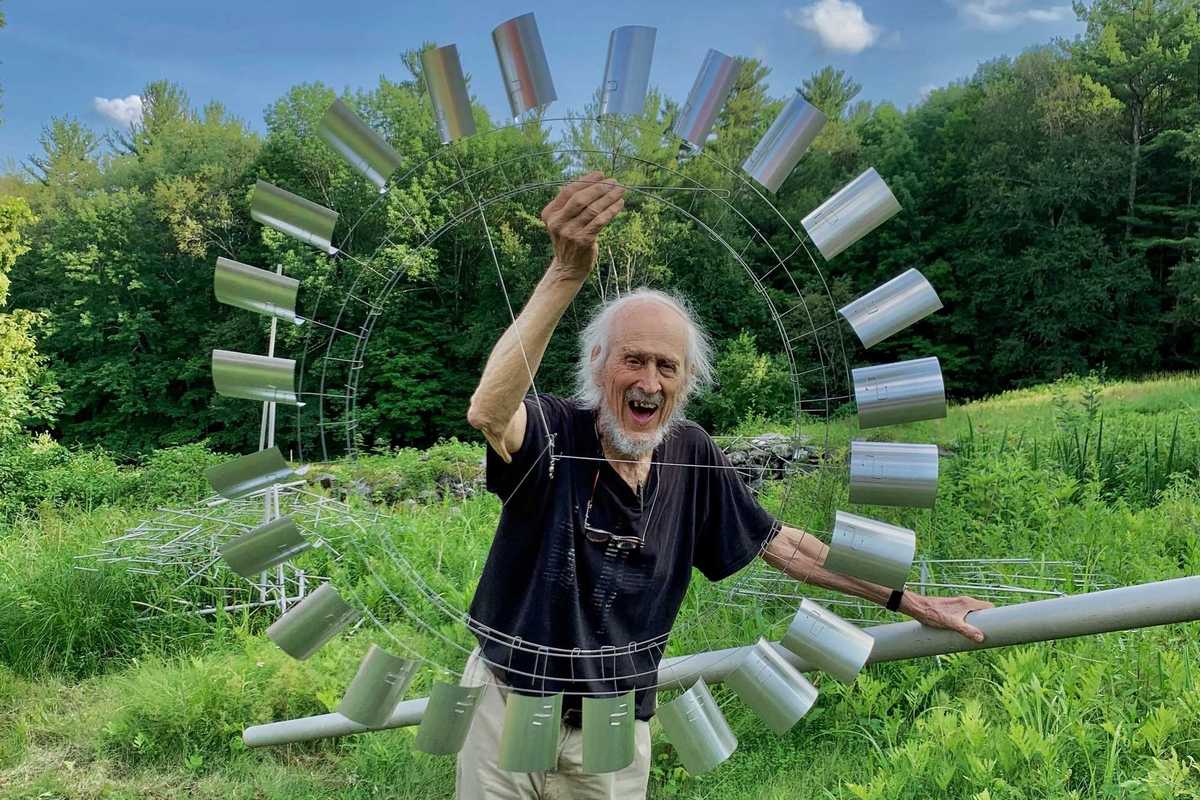

Tim Prentice and the art of making the wind visible

In remembrance:

Tim Prentice and the art of making the wind visible

There are artists who make objects, and then there are artists who alter the way we move through the world. Tim Prentice belonged to the latter. The kinetic sculptor, architect and longtime Cornwall resident died in November 2025 at age 95, leaving a legacy of what he called “toys for the wind,” work that did not simply occupy space but activated it, inviting viewers to slow down, look longer and feel more deeply the invisible forces that shape daily life.

Prentice received a master’s degree from the Yale School of Art and Architecture in 1960, where he studied with German-born American artist and educator Josef Albers, taking his course once as an undergraduate and again in graduate school.In “The Air Made Visible,” a 2024 short film by the Vision & Art Project produced by the American Macular Degeneration Fund, a nonprofit organization that documents artists working with vision loss, Prentice spoke of his admiration for Albers’ discipline and his ability to strip away everything but color. He recalled thinking, “If I could do that same thing with motion, I’d have a chance of finding a new form.”

What Prentice found through decades of exploration and play was a kind of formlessness in which what remains is not absence, but motion. To stand before one of his sculptures is to witness a quiet choreography where metal breathes, shadows shift and time softens.

After Yale, Prentice co-founded the architectural firm Prentice & Chan in 1965. The firm designed affordable housing projects in New York City, work largely led by partner Lo-Yi Chan. Prentice also designed custom single-family homes and continued to develop sculptural ideas alongside his architectural practice. After leaving the firm in 1975 and eventually relocating full time to Cornwall, he undertook a range of local architectural projects while increasingly devoting himself to sculpture.

Prentice began producing larger-scale sculptural commissions in the 1970s, during a period of national expansion in public art funding tied to new building projects. His first major commission came in 1976 from AT&T, helping launch a career that would bring his kinetic installations to corporate, institutional and public spaces across the United States and abroad. While his work follows in the lineage of Alexander Calder and George Rickey, critic Grace Glueck observed that its “gently assertive character is very much his own.”

In Cornwall, Prentice established a studio devoted to designing and fabricating kinetic sculpture, where he continued working for decades. He had many assistants over the years including local artists David Bean, Ellen Moon and Richard Griggs. David Colbert worked with Prentice for many years, assisting with fabrication, installation and project development and in 2012, Prentice established Prentice Colbert Inc., helping ensure that fabrication and development of large-scale commissions could continue beyond his lifetime.

Colbert said Prentice could be imperious, but came to understand that he valued thoughtful critique over agreement. “That evolved into a free and easy give-and-take, along with some fierce arguments,” he said. “Our relationship was always developing, right through to the end.”

In the mid-1990s, Prentice was diagnosed with macular degeneration, a condition that gradually narrowed his field of vision. Rather than turning away from the visual world, he leaned further into it, focusing on movement, light and peripheral perception — on what could be felt as much as seen. The Vision & Art Project film documents this period of his life and the ways he adapted his creative process.

Even in his final years, Prentice continued experimenting. In the summer of 2025, he created a series of drawings titled “Memory Trees,” produced from recollection as his eyesight declined. The series sold out at the Rose Algrant show that August, offering a poignant example of an artist adapting and creating throughout their lifetime.

“He was interested in whimsy,” said Nora Prentice of her dad. “But he also worked seven days a week,” she said. “He’d come in for dinner and then go right back out.” His studio was known for its atmosphere of curiosity and play, with music often drifting through the workspace as sculptures moved overhead in careful, measured rhythms. His work reminds viewers how profoundly small movements shape perception, and how change itself may be the only constant.

In his poem “Among School Children,” William Butler Yeats asks, “How can we know the dancer from the dance?” Prentice offered his own answer. “I’m not making the dance,” he said. “The wind is making the dance.”

As Nora reflected, “I think that’s how he would want to be remembered: for making the wind visible.”

Keep ReadingShow less

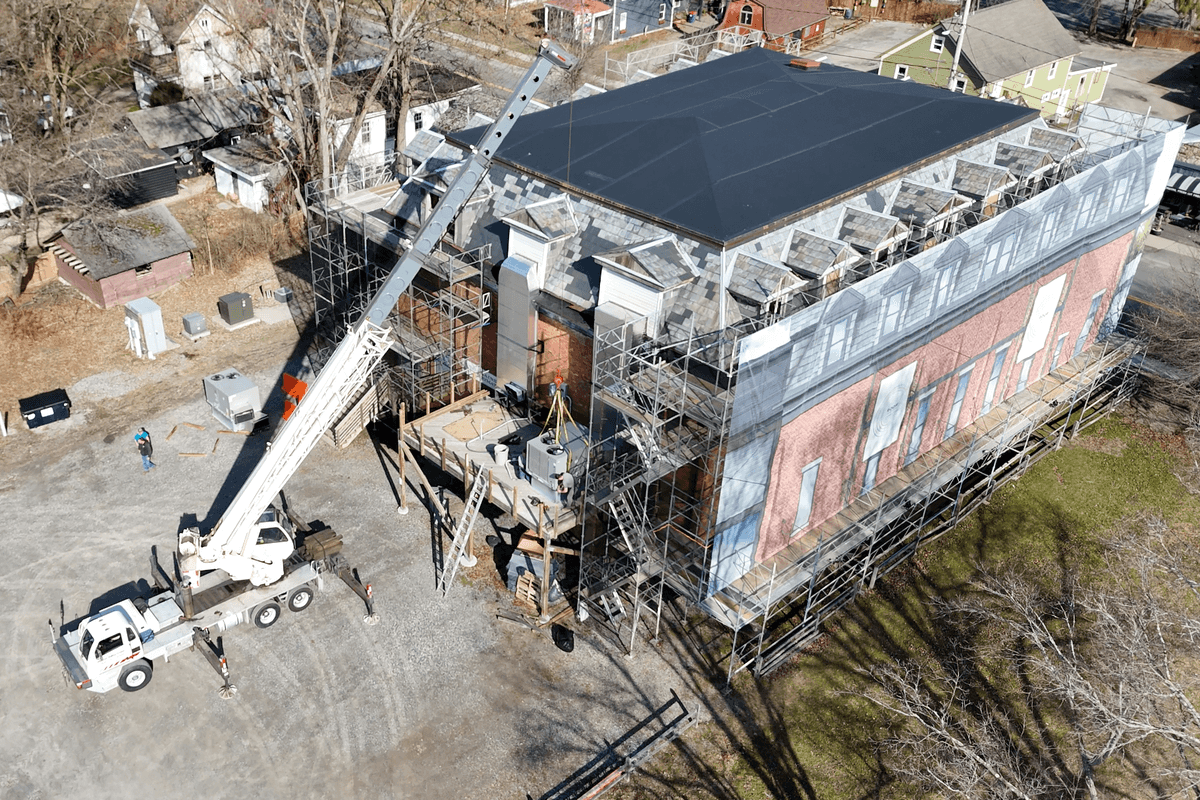

Hyalite Builders is leading the structural rehabilitation of The Stissing Center in Pine Plains.

Provided

For homeowners overwhelmed by juggling designers, architects and contractors, a new Salisbury-based collaboration is offering a one-team approach from concept to construction. Casa Marcelo Interior Design Studio, based in Salisbury, has joined forces with Charles Matz Architect, led by Charles Matz, AIA RIBA, and Hyalite Builders, led by Matt Soleau. The alliance introduces an integrated design-build model that aims to streamline the sometimes-fragmented process of home renovation and new construction.

“The whole thing is based on integrated services,” said Marcelo, founder of Casa Marcelo. “Normally when clients come to us, they are coming to us for design. But there’s also some architecture and construction that needs to happen eventually. So, I thought, why don’t we just partner with people that we know we can work well with together?”

Traditionally, homeowners hire designers, architects and contractors separately, a process that can lead to miscommunication, budget overruns and design revisions once construction begins. The new partnership seeks to address those challenges by creating a unified team that collaborates from the earliest planning stages through project completion.

“We can explore possibilities,” Marcelo said. “Let’s say the client is not sure which direction they want to go. They can nip that in the bud early on — instead of having three separate meetings with three separate people, you’re having one collaborative meeting.”

The partnership also reflects an expanded view of design, moving beyond surface aesthetics to include structural, environmental and performance considerations. Marcelo said her earlier work in New York City shaped that perspective.

“I had a 10-year career in New York City designing townhouses and penthouses, thinking about everything holistically,” she said. “When I got here and started my own business, I felt like I was being pigeonholed into only the decorative part of design. With the weight of an architect on our team now, it has really helped us close those deals with full home renovations, ground up builds and additions.”

The team emphasizes what it describes as high-performance design, incorporating modern building science, energy efficiency and improved air quality alongside aesthetic goals.

“If you’re still living inside 40-year-old technology and building techniques, we haven’t really handed off the best product we could,” said Soleau. “The goal is to not only to reach that level of aesthetic design but to improve the envelope, improve the living environment within a home and bring homes up to elevated standards of high-performance building.”

This integrated approach has proven particularly useful for renovation projects, where modern materials and systems can be thoughtfully incorporated into older structures. The firms also prioritize durability and long-term functionality, often incorporating antiques, vintage elements and high-quality materials designed to support clients’ lifestyles.

“I’m very big on investing in pieces that are going to be quality and last you the test of time,” Marcelo said. “Not just designing for a five- to 10-year run, but really designing for the long haul.”

The collaboration is already underway on several projects, including a major renovation in Sharon that involves rebuilding a 1990s modular home to maximize views while upgrading structural and performance systems. The firms are also exploring advanced visualization technology that would allow clients to experience projects through virtual reality before construction begins.

“For me, as somebody who wants to take the project all the way from beginning to end and make the process as effortless as possible for my client, it’s easier to do that with collaboration and a team than to do it alone,” Soleau said. “Most clients, especially second-home owners, want a team that can lead the project from concept through completion; aligning design, budget, and construction.”

On Feb. 19, the three firms will officially launch the initiative at an invitation-only event at The Stissing Center in Pine Plains, where Hyalite Builders is leading the structural rehabilitation of the historic building. A limited number of “hard hat tour” reservations will be available by request, providing rare, behind-the-scenes access while work is actively underway. Those interested in attending may contact event organizer Lauren Fritscher of Berkshire Muse at hello@berkshiremuse.com.

Keep ReadingShow less

loading