In the face of uncertainty over the fate of regional banks, the U.S. central bank hiked interest rates and said it would continue with its program of quantitative tightening.

Stocks fell and bonds rose after the FOMC meeting on Wednesday, March 22, however, the real drama was elsewhere. U.S. Treasury Secretary Janet Yellen was testifying before a Senate Appropriations subcommittee at the same time as the Fed meeting. She told lawmakers that she has not considered or discussed “blanket insurance” for U.S. banking deposits without approval by Congress.

Many traders in the markets had just assumed that since the government had made all depositors whole in both Silicon Valley Bank and Signature Bank, all depositors would be bailed out. Yellen made it clear that was not the case. That statement shook investors’ confidence once again, given that there has been a continued outflow of deposits from smaller regional banks to the large money center banks.

Readers should know that the FDIC insures those with deposits of $250,000 or less, but that’s the limit. To change that regulation, Congress would have to act. That would take time and in the hyper-partisan atmosphere of the present Congress, it is doubtful that the limit would be changed.

Interestingly, those who listened to Fed Chairman Jerome Powell’s answers in the Q&A after the FOMC meeting took away what they wanted to hear. Many in the bond market, for example, now believe that there will be no more interest rate hikes and that the Fed will begin to cut rates before the end of the year.

The financial issues that are plaguing the banks, they believe, will result in less loan growth across the entire financial sector. That will in turn slow the economy and put added pressure on the inflation rate. In other words, the regional bank crisis will do much of the work for the Fed going forward.

On the other hand, more and more economists are convinced that we are on the verge of an economic slowdown that will result in at least a mild recession. The Fed’s continued tightening, which has already caused some breakage (regional banks) will go too far and risk a hard economic landing. That in turn will cause corporate earnings to decline and with them the stock market.

My take is that nothing has changed after the FOMC meeting. Jerome Powell said he could pause further rate hikes, if necessary, but “rate cuts are not in our base case.” He did not say that we won’t see further interest rate hikes in May and June. He did say that the issues in the banking sector were real, however, and triggered a credit crunch with significant implications for the economy and the markets.

To be clear, no one, not even the Fed, knows which scenarios will turn out to be correct, or maybe some of each will occur in some form or another. The point is that we are in an environment where every headline has the power to move markets up or down by more than one percent or more daily.

I said that will result in a choppy market, which will keep the major averages in a trading range. Last week, the 200-day moving average (DMA) trendline of 3,934 on the S&P 500 Index was tested once again and bounced. Upside resistance is hovering around 4,012. That range will ultimately be broken when enough data points give the market a new direction.

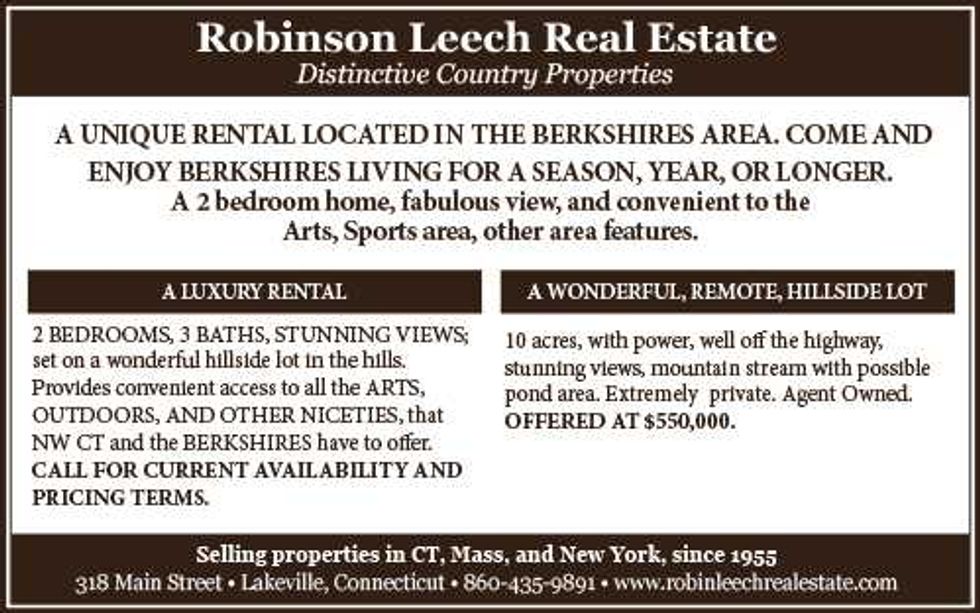

Bill Schmick is a founding partner of Onota Partners, Inc., in the Berkshires. None of his commentary is or should be considered investment advice. Email him at bill@schmicksretiredinvestor.com.

Local parents, child care providers and nonprofit representatives outline the challenges they face in accessing and providing childcare in rural northeast Dutchess County during a forum at the Stissing Center in Pine Plains on Wednesday, Feb. 25. Photo by Nathan Miller

Local parents, child care providers and nonprofit representatives outline the challenges they face in accessing and providing childcare in rural northeast Dutchess County during a forum at the Stissing Center in Pine Plains on Wednesday, Feb. 25. Photo by Nathan Miller

lakevillejournal.com

lakevillejournal.com

The Fed walks a tightrope